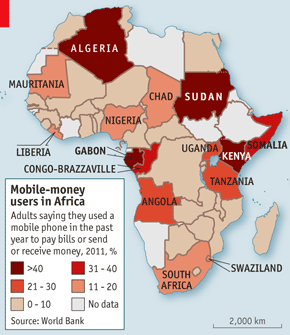

Another type of Mobile Banking is where your bank is on your phone. Africa is far ahead of the rest of the world in mobile phone banking. In this article by The Economist, called Press 1 for Modernity, it states that "Three-quarters of the countries that use mobile money most frequently are in Africa" More than half of adults bank over their mobile phones in Kenya, Sudan and Gabon. These are some of the highest rates in the world.

Think about that - half of all people in Sudan are banking over their mobile phones. That is truly amazing.

This is a leapfrogging of technology that is common in developing countries where infrastructure costs can be exorbitant. Many developing countries skip land lines and go straight to cell phones. Likewise, they are skipping brick and morter and moving straight to banking on their cell phones.